Capital Rx

Self-funded employers face persistent pressure to control costs while providing their employees with a comprehensive benefits package that offers access to the best possible care. One piece of the benefits puzzle has emerged as particularly problematic over the last few years: the pharmacy benefit, which has ballooned to 25% to 30%,1 if not more, of most employers’ total health benefit costs.

“You can’t ignore pharmacy in a discussion about getting to an outcomes-based medical world. The medicines patients take are vitally important to their health and well-being. Similarly, you can’t ignore pharmacy on the benefits side, and having an aligned partner helps assure that your plan members have access to the medication they need.” - Sunil Budhrani, MD, MPH, MBA, Chief Innovation & Medical Officer

But how can employer plan sponsors hope to understand the complicated world of pharmacy benefits management (PBM) and optimize their programs? It’s easier said than done, but it starts with an understanding of what the role of a PBM should be and how traditional PBMs have long operated in the shadows, creating inefficiencies that drive up costs and obscure true value. And then you can find the opposite: a “transparent PBM” whose sole interest is integrating a benefit that works with your broader healthcare strategy.

Let’s start with the basics.

What is a PBM?

PBMs are companies that serve as intermediaries between health plans, pharmaceutical manufacturers, and pharmacies. They handle the critical administrative functions that enable payers of all kinds – employers, unions, municipalities, health systems, health plans, and even government entities – to provide prescription drug coverage to beneficiaries, including, but not limited to:

- Plan design and setup, eligibility, etc.

- Claims processing and adjudication

- Formulary management (the list of covered drugs)

- Pharmacy network contracting and management

- Rebate negotiations with pharmaceutical manufacturers

- Prior authorization and utilization management

- Member services and support

For more details about the role and responsibilities of a PBM, check out What Is the Role of a Pharmacy Benefits Manager (PBM)?

Why Traditional PBM Models are Flawed

Traditional PBMs have created several well-documented challenges for self-funded employers and other pharmaceutical supply chain stakeholders – e.g., independent pharmacies – since the early 2000s, and the consequences of their business decisions have magnified over the years. We’ll focus on three fundamental issues here that make choosing a transparent PBM partner a critical component of any health benefits strategy.

Lack of Transparency

Since PBMs evolved away from a purely administrative role and began earning a “spread” on drug prices, their profits have exploded, sources of revenue expanded, and – most notably – spending on pharmaceuticals in the U.S. has skyrocketed to over $1 trillion based on list prices.2

Additionally, access to plan data (e.g., claim-level data) and information surrounding clinical and other decisions made on behalf of the plan sponsor by the PBM may be difficult, if not impossible, to obtain.

Related Coverage of Claims Data Access Issues

- AH064 - Empowering Plan Sponsors: Data Access & Analysis, with Bridget Mulvenna

- AH048 - High-Cost Orphan Drugs, Securing Claims Data, and More, with Dr. Eric Bricker

The result is a uniquely one-sided business relationship whereby it’s nearly impossible to understand true pharmacy benefit costs and cost trend, and that makes it incredibly difficult for plan sponsors to make informed decisions about their benefit programs.

Drug Pricing is Not Clear

Most PBM contracts rely on pricing models built on outdated metrics such as Average Wholesale Price (AWP) or other benchmarks that AWP may influence. This obscures the actual cost of drugs and creates opportunities for unnecessary markups (i.e., “spread pricing”). It also results in variable pricing, which can negatively impact plan members’ experiences at the pharmacy counter.

In Why Use NADAC-Based Pricing Over AWP, we objectively cover this issue in more detail. It’s also worth noting that the plan sponsors we work with generally appreciate the transparency that NADAC brings to their benefits programs.

Misaligned Incentives

Many traditional PBMs profit from higher drug spending through spread pricing and retained pharmaceutical manufacturer revenue, including a portion of rebates. This creates a fundamental conflict of interest because a PBM's financial success may not align with a plan sponsor’s or a member’s cost management goals.

This is where the integration of pharmacy benefits with medical claims processing becomes critical for self-funded employers seeking to optimize their total cost of care and improve member outcomes. If a relationship with a PBM vendor exhibits any signs of the traditional issues, it’s time to consider issuing a request for proposal (RFP) to determine if a more transparent partner could better meet your needs so you’re prepared for the future.

Why is partnering with a transparent PBM so important?

First, clear pricing and the full pass-through of pharmaceutical manufacturer revenue are expected with any transparent PBM. At Capital Rx, we earn a flat administrative fee and discuss “pharmaceutical manufacturer revenue” more broadly, because there are more sources of money beyond rebates, which could be retained by a traditional – or not fully transparent – PBM.

While we would also encourage plan sponsors to consider breaking the global “addiction to rebates,” and we often explain how managing drug mix helps and leads to lower overall plan costs, we believe that any revenue associated with filling a prescription for a plan member should flow through to the health plan.

Pharmaceutical Rebate-Related Content

Read: Pharmacy Benefits 101: Pharmaceutical Rebates

Watch: Will Biosimilar Rebates Pass-Through?

Second, a transparent PBM’s incentives should be completely aligned with a client’s interests. If a PBM earns more when a more expensive drug is filled for a plan member, whether due to the prior authorization process or because they own a retail, mail-order, or specialty pharmacy, it presents a conflict of interest. With a truly transparent partner, plan sponsors have reassurance that decisions are made with their and plan members’ best interests in mind. This helps them meet their fiduciary obligations under the Consolidated Appropriations Act.

“A great fiduciary test for any plan sponsor is to see if their PBM vendor can make money on an error, such as steering a patient to a specific pharmacy, making a clinical decision, classifying a drug one way or another, or other formulary decisions. Too often, the answer is yes, and that’s a serious concern.” – AJ Loiacono, Co-Founder & CEO

Third, access to plan data is never an issue with a transparent PBM. With Judi®, plan data is literally at the plan sponsors’ fingertips.

Fourth, transparent PBMs should be willing to work with any vendor and provide enhanced cost visibility. Reporting and analytics should offer a window into medication utilization patterns and cost drivers, enabling data-driven decision making.

Lastly, a transparent PBM should be able to explain its focus on its investment strategy, and how its clients will benefit. Are profits going to R&D to improve its technology and product offerings (e.g., enhanced clinical programs)? What investments in AI are underway? How will client and member support services benefit? With a better tech stack and care coordination, transparent PBMs can react quickly to client needs (e.g., customization requests) and support more effective clinical programs and interventions.

How do you find and choose a transparent PBM?

We’re so glad you asked. 😊

First, you’ll have to run an RFP. Hopefully, you can find and work with a benefits broker or consultant whom you’ve vetted for transparency, and they can support the process of evaluating prospective PBM partners. At a minimum, consider these critical factors:

- Contractual transparency: Contract language should be clear, and pricing arrangements disclosed. Ensure that performance guarantees align with your needs and that all rebates, fees, and pricing arrangements are disclosed.

- Technology capabilities: Look for PBMs with modern platforms that can integrate with your existing systems and connect with other vendors you may wish to work with.

- Clinical expertise: Focus on drug mix and the PBM’s ability to support population health initiatives.

- Reporting and analytics: What level of access do you have to plan data and how willing is a PBM to provide usable data and reports?

- Implementation support: Consider the PBM's track record for smooth transitions.

Capital Rx & Judi Health™

Capital Rx’s business model exemplifies transparency. Built on the Judi Health platform, Capital Rx offers:

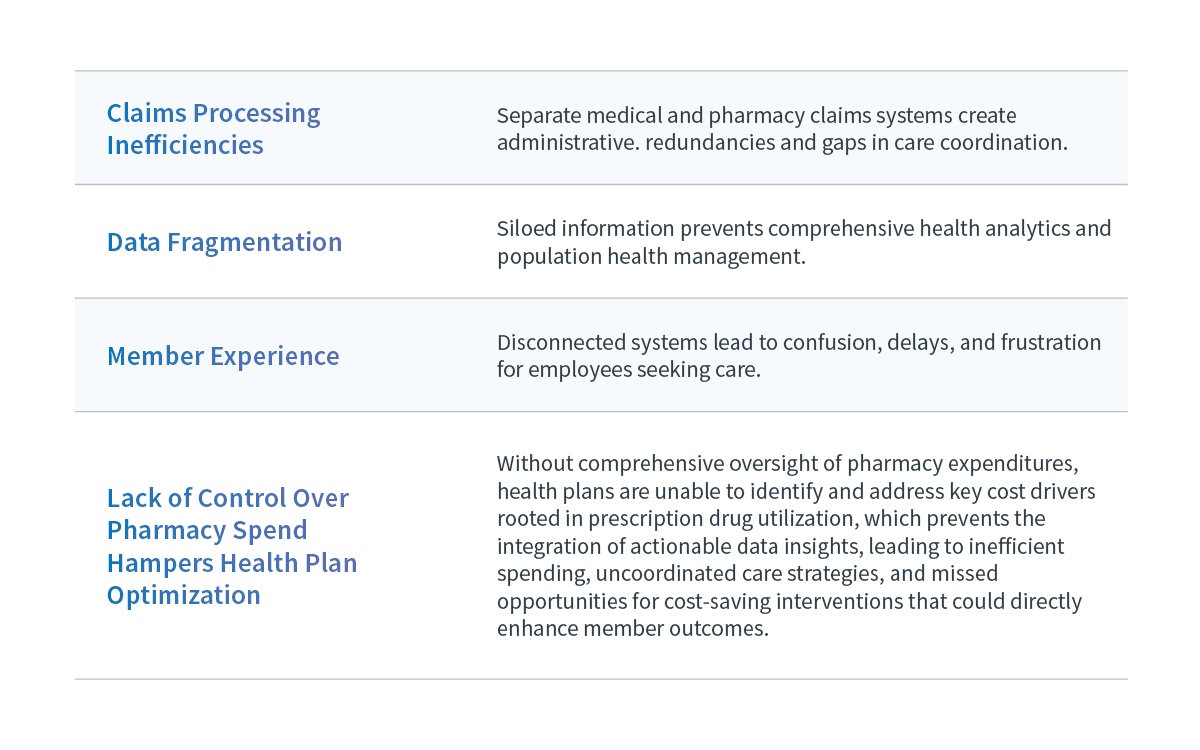

- Unified Claims Processing™: The first platform to integrate a medical and pharmacy benefits experience on a single system.

- Complete Transparency: Full pass-through of all manufacturer revenue with clear fee structures.

- Modern Technology: Cloud-native architecture that scales with your needs.

- Comprehensive Analytics: Real-time insights into costs and utilization trends.

- Seamless Integration: Ability to work with existing vendors while centralizing data and workflows.

The Judi platform represents a fundamental shift from traditional PBM models, offering Capital Rx’s team a unique resource to service plan members and self-funded employers the transparency, efficiency, and control they need to optimize their healthcare programs.

Transforming Healthcare Through Transparency

The future of health benefits administration lies in transparency, integration, and technology-enabled efficiency. Addressing the lack of transparency in the pharmacy benefit program is a step in the right direction. Self-funded employers who embrace this responsibility today position themselves to achieve sustainable cost management while delivering superior care to their employees in the future.

Ready to explore how a transparent PBM model can transform your healthcare program?

Get in touch to learn more about how Capital Rx is a transparent PBM and health benefit administrator.

1 Business Group on Health. 2025 Employer Health Care Strategy Survey. August 2024. Available at: https://www.businessgrouphealth.org/resources/2025-Employer-Health-Care-Strategy-Survey-Intro.

2 Source: IQVIA Institute for Human Data Science. Understanding the Use of Medicines in the U.S. 2025: Evolving Standards of Care, Patient Access, and Spending. April 2025. Available from www.iqviainstitute.org

.png)